Why Warren Buffett finally into gold and why you should pay attention to silver, platinum and BTC

- Agris Gruzdas

- Aug 19, 2020

- 3 min read

Let’s look at several recent activities by Berkshire Hathaway: the sale of Goldman Sachs, a 61% reduction in JP Morgan Chase and the sale of a large stake in Wells Fargo and keeping positions in Bank of America unchanged. At the same time, a large purchase (20,9 million shares) of Barrick Gold Corp. has been made.

If we look at the banking sector in America, it is not surprising at all.

Since 2008 crisis, the sector has not recovered yet. Look at the broken trend line with executed figure "head and shoulders". And there is a lot of talk about the "debt bubble". If this bubble is blown bigger and bigger, it will certainly not have a positive effect on this sector.

So, Buffett bough a gold mining company. Which is rather a big surprise, since Buffett has long denied investing in gold. But, if you look at this year's performance of gold mining companies and compare it with the banking sector… Then the logic of the deal is more than understandable.

Here is a comparison of the Banking Sector (KBE) and the Gold Miners ETF. The banking sector has fallen by 20% today, while gold mining has risen by 100%

So, no real surprise here.

I had long written about gold, and the relationship between gold and silver, especially about potential silver “out-performance”. And here it is – the ratio of gold to silver has dropped by 40% this year, meaning that the silver has been "stronger" than gold.

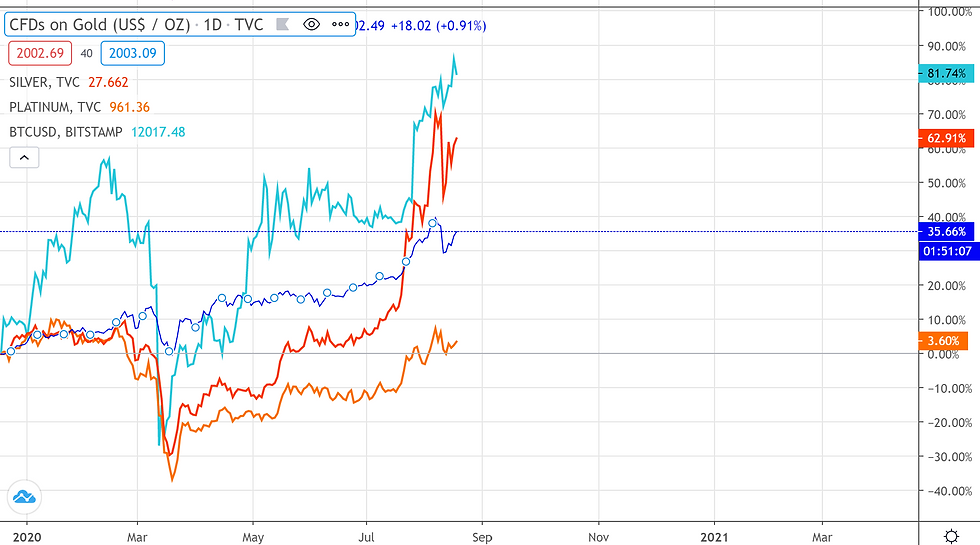

If someone wants to be even more aggressive, then I see a huge potential for bitcoin. Looking at this year's results so far, bitcoin has been the most successful investment, followed by silver, gold and finally platinum.

If we look at BTC in more detail technically, the bitcoin has gone out of a long triangle and executes the figure “head and shoulders”. Yes, this is a weekly graph and yes, corrections are expected, as BTC has to reach its first resistance point – the price level of 12,000.

I think a correction is expected. The adjustment should follow the smaller graphs (Daily and not lower than the H4 graphs). So, look out for an opportunity to supplement your positions.

The potential for silver is also huge (as for the gold-to-silver ratio). Silver has been at low price levels for a long time until it has experienced a sharp rise in prices and reached a resistance level in the price corridor of USD 26-28. The closest goals are the previous highs of USD 35, then the USD 44 mark, and then the historical highs of USD 50.

Gold has gone through all its resistance levels and has already reached new highs. Now only “sky is the limit”. I think that gold will stay there for some time or experience a slight correction.

The platinum price seems the most attractive at the moment. Located close to its historical minimum and the price potential is huge. It does look "relatively cheap", indeed. Still, since I don't know much about platinum, I trade it cautiously with reasonable risks.

None of these recommendations should be treated as a call-to-action. There’s no “smooth ride” in all this. Prices will rise and fall, there will be unexpected news, there will be unpredictable events. However, it's worth paying attention to these financial instruments, especially when mighty Buffett points us towards these instruments.

Stay tuned!

Agris

Comments