My Optimistic Take on AI’s Pessimistic Forecast for 2026

- Agris Gruzdas

- 4 days ago

- 9 min read

New Year, New Forecasts!

Again, we must try to be smarter than the rest, as I wrote in one of my previous blog posts: Is it possible to be smarter than the rest of the world? The questions still stand – is it, really?

Well, having all those shiny tools under your belt: Google, AI, and the internet as such, creates an illusion that is actually possible. Real-time macro data is easily available, Artificial Intelligence-generated forecasts, numerous instantaneous forecasts/podcasts of the best analysts can be found, and so on. Not to mention social media sentiment can be read quite quickly…

Still, it’s not that simple at all. Simply because information itself is no longer something unique and inaccessible. On the other hand, data interpretation – that’s what makes a real difference here. Simply put: information is no longer the edge - interpretation is!

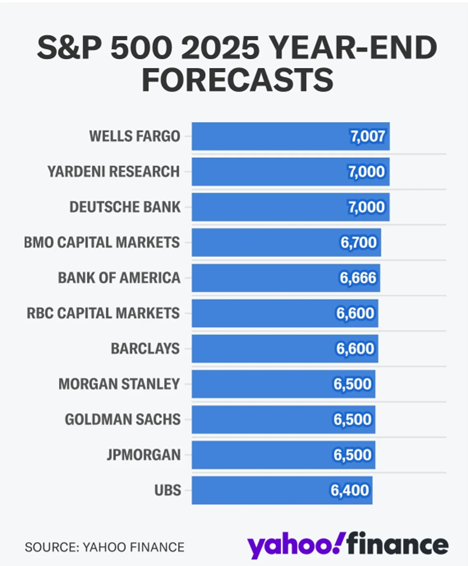

Looking back at my blog post – let's see how accurate Big Banks predicted the S&P500 for 2025:

As you can see, the forecasts have had a fairly large amplitude. And remembering the beginning of the year and all that nonsense with Trump’s tariffs, a large part of these forecasters changed their forecasts downwards. For example, RBC even at one point lowered its forecast to 5500 for the S&P500. As well as other institutions, changed their forecast for the worse.

And how did 2025 end in reality? The S&P500 ended the year at a mark of 6845.50.

• Average forecast: 6670

• Actual outcome: 6845.5

• Consensus error: –175.5 points (–2.6%)

As a matter of fact, in financial markets, this is very good accuracy for annual forecasts.

Brief conclusion:

Overall, the forecast was pretty good. Considering that the typical daily range (ATR) of the S&P 500 is around ~0.9%, the consensus error (~2.6%) corresponds to only about 3 normal trading days. This means that the annual forecast was within a very narrow margin of error.

And all this despite the loud headlines: about how bad everything is, that the economy may even experience a RECESSION, etc.

I may sound like the old record: don’t pay attention to the news headlines! Instead, measurable data is needed that makes an actual impact. An assessment – either in export/import transactions or in the assessment of manufacturers. If you simply rely on news portals, you are aiming at disaster. Either way, you have to be able to interpret the given information and be rational about it, especially when you put Trump in that equation 😊 😉. That’s what I’ve been constantly reminding in my program courses: THINK before you DO! So, you don’t get that feeling that you are “grinding through shit” over and over again if you expose yourself only to news headlines every single day.

Although, to be honest, not everything is so clear-cut these days: entrepreneurs/manufacturers/service providers have also regularly expressed their negative opinion about the economy/tariffs. How unstable/jumpy suppliers are right now, and how fragile customer sentiment is. Unfortunately, more and more manufacturers’ reports and insights mention that one single word that keeps repeatedly popping up – tariffs, tariffs, tariffs…

And here we are back to interpretation. You can talk and write a lot, but the data always shows a “cleaner picture”. Although the manufacturing sector has been “sluggish for a long time”, the economy is still coping with it. Manufacturers are more than compensated by the service sector. And this has been the case for the last 3 years.

And seeing the pace at which artificial intelligence is developing. Seeing what investments are being made in this sector. Seeing what market participants are getting involved in (all the TOP largest technology companies). Seeing how many industries are “pulling along” – data centers, chip manufacturers, and computer component manufacturers in general (not to mention the increasing price of computer memory chips), energy producers and storage provider,s and therefore also network infrastructure, cloud data services, cybersecurity, robotics, autonomous logistics… It can be safely said that artificial intelligence is currently creating a completely new industrial ecosystem, similar to electrification in the past, or similar to the Internet in the 1990s. Looking at all this – it’s hard to call it a Bubble!

What is a Bubble then? When capital flows into assets without a real demand base, without cash flow coverage, and the price increases “from stories and legends”. As it was during the dot.com bubble, when websites were created without business models, as it was in the Crypto Token bubble in 2017, when tokens were created without a real use, but rather just with a good or sometimes even fantastic story.

With AI, it is different – there is real demand, there are real projects, there is cash flow. And speaking of cash flow, many say that these investments do not justify themselves, etc. But the only companies that can actually build it are the top technology companies, which are also, if anything, able to “swallow” these expenses: both at the expense of their profit and at the expense of their cash flow. META also understands these risks and opportunities very well:

Mark Zuckerberg has acknowledged the risk of an AI bubble but maintains that the cost of building too slowly is higher. He has stated that if Meta overbuilds, they will “grow into” the capacity over time.

In short: let's not worry about the Bubble. Let's follow the developments and data, not the headlines and negative opinions. They are usually the loudest and the brightest. In reality, the GDP in the US is experiencing an increase, reaching more than 4% in the 3rd quarter, which will result in an annual growth of ~2.5%. And FRED predicts a similar increase in 2026. Despite the unpredictable policy of the White House and the ongoing war in Ukraine.

And here we are back to the forecasts. If we have already understood that the “average” forecast of large banks / large market participants is worth considering, then let's see what they say. But before that, let's see what AI tells us about the 2026 Market Outlook:

2026 Market Outlook — Summary

Interest Rates

By 2026, peak rates are behind us — but the era of free money is not coming back. Central banks will cut cautiously, not aggressively. No liquidity tsunami. No effortless rallies.

Growth

Economic growth will look acceptable — not strong, not disastrous. The real risk is expectations: markets are pricing a flawless soft landing. Reality rarely delivers perfection.

Debt

Public debt will not suddenly explode — it already has. 2026 is about servicing that debt in a world where capital has a real cost. This won’t crash markets. It quietly caps upside.

Stock Indices: The Quiet Trap

Indices may remain near highs, but internal market health will be fragile.

Index performance ≠ stock performance

A small group of mega-caps can keep indices elevated while:

• Most stocks stagnate or decline

• Volatility lurks beneath the surface

• Market leadership rotates rapidly

Passive investing still works — just slower, and with sharper emotional drawdowns.

AI: Productivity, but No Longer a Market Surprise

AI is real. AI boosts productivity. AI does not remove market cycles.

By 2026, AI will become:

• Essential

• Ubiquitous

• No longer a guaranteed growth narrative

Markets don’t pay for technological truth. They pay for surprises.

And by 2026, AI will surprise no one.

Well, not very positive. And when I asked AI to generate a picture for their “2026 Market Outlook”, the picture became even bleaker…

Going back to the “old school” forecasters:

Goldman Sachs: The S&P 500 Is Expected to Rally 12% This Year!

Healthy economic growth and Fed easing are expected to help propel the US stock market this year.

While stock valuations are high and stock market capitalization is the most concentrated on record, there are notable differences between the ongoing AI rally and historical investment booms.

Goldman Sachs Research expects AI investment to increase this year, even as the growth in capex decelerates.

Five key investment themes in 2026 are expected to be: accelerating GDP growth, corporate re-leveraging, AI adoption, a rise in IPOs and dealmaking, and a search for value stocks.

Admittedly, it is incomparable to AI, and it’s "outlook on life".

J.P.MORGAN: Key takeaways

J.P. Morgan Global Research is positive on global equities for 2026, forecasting double-digit gains across both developed markets (DM) and emerging markets (EM).

Looking at the economy, J.P. Morgan Global Research forecasts a 35% probability of a U.S. and global recession in 2026, and sticky inflation will likely remain a prevailing theme.

Most DM central banks are expected to either stay on hold or conclude their easing cycle in the first half of the year.

While J.P. Morgan Global Research continues to be bearish on the dollar for 2026, it is moderately bullish on the euro.

Considering that JP Morgan published its forecast in December 2025, no one probably expected the gold price to be 5k and above already in January 2026. Possibly they are predicting price fluctuations in this range….

But what they are really predicting and what is very difficult to dispute: a further breakout of MAG 7.

Bank Of America:

“From energy grids and data centers to defense systems and digital platforms, power is driving the global economy — and shaping the outlook for 2026.”

— Chris Hyzy, Chief Investment Officer, Merrill and Bank of America Private Bank

“The U.S. economy is firing on all cylinders,” says Joe Quinlan, head of Market Strategy for the CIO, who cites six reasons equity prices could potentially keep advancing:

Resilient consumer spending. Lower-income households are beginning to struggle with rising costs, but wealthier individuals and families, who account for more than half of consumer outlays, have been buoyed by investment gains and rising home values, a report by the Bank of America Institute notes.1 What’s more, strong spending by retiring baby boomers is providing a boost for the economy, helped in part by Social Security cost-of-living adjustments that have surpassed wage growth recently.2 “Boomer spending continues to be one of the largest tailwinds in the economy overall,” adds Hyzy.

Corporate capital expenditures. The extraordinary investments in infrastructure around artificial intelligence are powering high levels of spending by U.S. companies. “The data center buildout is so strong that we’re spending almost as much there as we’re putting into the construction of office buildings,” says Quinlan.

The One Big Beautiful Bill Act. Last summer’s passage of this sweeping legislation provides capital depreciation allowances for companies and other tax advantages that should help fuel still more capital expenditures in 2026.

The decline of the U.S. dollar. For U.S. exporters and multinational companies with overseas operations, a dollar that is losing value against other currencies helps drive earnings growth by boosting the competitiveness of U.S. goods and services.

Rebounding global economic growth. Many countries have responded to U.S. tariffs and trade frictions by redoubling their own efforts to expand their economies, cutting interest rates to spur growth. As a result, the global economy is accelerating as 2026 begins.

Expected further cuts by the Federal Reserve. “We’re in the mid-innings of a Fed easing cycle, which is typically very bullish for equities,” Quinlan says.

MORGAN STANLEY: 2026 Investment Outlook: U.S. Stocks Shine in Spotlight of Favorable Conditions

Key Takeaways

U.S. stocks are likely to outpace global peers, with the S&P 500 projected to gain 14% over the next year.

U.S. equities should outperform global peers in 2026, with the S&P500 rising to 7,800 in the next 12 months—a 14% gain from its current level, compared with expected gains of 7% for Japan’s TOPIX and 4% for the MSCI Europe.

Government bonds—particularly in the U.S.—are likely to rally in the first half of the year as central banks shift from inflation control to policy normalization, but decline in the second half.

The U.S. dollar could weaken early in 2026 but rebound in the second half; European currencies may lose strength as rate cuts take hold.

“2026 should be a choppy year for the U.S. dollar index,” Tang says. “The decline and rebound reflect shifts in rate differentials and changes in risk premiums.”

Massive capital needs for AI infrastructure and M&A deals should drive corporate bond issuance in the U.S. and Europe.

Looking at the “classic, old school” forecasters – the Devil is definitely not as black as the headlines and the “murky AI opinion” paint it. I will not continue to quote the others (such as BlackRock, etc.) so as not to stretch this blog for too long, since the picture and trends are obvious – the market expects growth, and the overall sentiment has improved.

Whatever it may be with AI, what interests us is the rise in stock values, and we, as “swing traders,” must be able to use the opportunities provided. What I see – the trend is growing. A RECESSION is not expected, the growth cycle is not over, and as I have written before: “There has never been a situation when the growth cycle ended at the ISM mark of 50. Of course – there can always be a first time 😉...

If you want to understand my view on the markets in more detail, you are welcome to join me at https://investingshortcuts.eu/ courses (some of them are FREE!) or through my Personal Helpline, one-on-one private tutoring sessions.

Stay tuned!

Agris

Comments