Is this the top or we are getting ready for the final run?

- Agris Gruzdas

- Jun 2, 2021

- 6 min read

As the hottest topic now is cryptocurrency, there is nothing left but to trade crypto and write about it. The crypto topic is getting more and more eye-catching as another day goes by. This time I want to look at the Bitcoin and crypto market purely from technical point of view. Without going into any profoundly deep articles and stories about why crypto, why now, how it will affect our future, and so on.

The only thing I want to mention quickly is Elon Musk's tweet. Last cycle when the crypto experienced its bull run we had now infamous Twitter "Specialist" John McAfee (yes, the famous creator of antivirus) who was a very active promoter of cryptocurrencies and now has to face a trial over promoting cryptocurrency offerings on Twitter. In this cycle we have Elon Musk. I don't want to say anything bad about him, he is a great businessman and innovator, but he already has a sad experience with his tweets and let’s see how this situation unfolds.

Nevertheless, what I wanted to say about all this is that we have to be very critical about the information we get from various social media sources, "trading Gurus", influencers, etc. Information from people who most likely are getting paid for one view or another. And If your trading strategy is based on Mask’s tweets, for example, then you can only blame yourself.

I suggest that to everyone, especially when it comes to trading needs to learn how to filter information. Articles like “Bitcoins consuming a huge amount of energy”, “China bans mining” are old topics, really that have been highlighted again and again. So, it's just a noise. Do some thorough research before making decisions. Your decisions must be made by you and not by someone you read on twitter or elsewhere!

Now let’s return to the main theme of this blog post – Bitcoin.

Let's start from the top down. The only thing you can compare Crypto is Internet. Nothing else develops so fast. I can compare this only with advances of the internet. This picture very accurately describes the potential of Crypto.

When we want to compare the development of cryptocurrencies and internet it is clearly evident that the crypto market is taking rapid steps forward. Do you remember how internet companies evolved? They experienced the fastest growth after internet had been adapted to daily use. A good example is Amazon. Founded in 1994, it started to experience rapid growth only after 2000. However, there’s one big difference, though – the Internet infrastructure is ready, and the adaptation period moves forward much faster than it did with internet companies.

Now, assuming that the crypto will experience as rapid growth as the Internet – what’s the price should we expect? Twitter user PlanB @ 100trillionUSD was looking for an answer to this question and came up with a stock-to-flow model.

You can find more information here, here and here. As you can see – the potential is huge, to say the least. Here again, we see the huge price potential that many are talking about. The mystical price of 1 million was also mentioned in the previous cycle. We do not know if this will be the case, but what we can see that Bitcoin stubbornly sticks to this forecast.

When we look at the total crypto market capitalization in the long run, then it is evident that it is also growing steadily. With its ups and downs, but with a steady tendency to grow. And at the moment, the cryptocurrency market capitalization is $ 1.67 trillion.

Although you need to look at this graph with great skepticism. Simply because a lot of crypto projects are questionable, like it was in the previous cycle with ICO bubble. Basically, now is a similar situation and many of current crypto projects will simply disappear. Now, if we look at the total crypto market capitalization excluding Bitcoin, that figure would be around $ 950 billion. And if we subtract the second largest cryptocurrency Ethereum (with capitalization of $ 350 billion), then we get a market capitalization figure of $ 600 billion. Well, these 600 billion are in real limbo since many of these projects are questionable.

Now, let's look at the last three BTC parabolic cycles.

As you can see, the increase is simply phenomenal, a really unprecedented increase. At the same time, at the end of each cycle, there is a drop of 85%! And every time it happens when the parabola is broken. All times the rise has been for two years and the fall has been for two years.

The question immediately arises – how much time is left for this rise again?

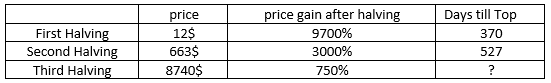

We can also look graphically at this as Bitcoin halving. When we put these Halving dates on the schedule, then it is clear that it has a huge impact on the price. Each time after this event, the price has risen.

Has this cycle already reached its peak? If we stick to the fact that the crypto market is growing similarly to the Internet and the stock to flow model says that the peak for this cycle is in the range of 100k - 300k then BTC still has to climb +/- 100% within this cycle. It is now 382 days since the last Halving, and if we compare data with the previous cycle, the price chart looked like this (exactly 382 days after Halving):

Interestingly, both cycles are experiencing a decline at about the same time, and in the previous cycle, after this adjustment, the price increased by another 1000%. ALL THIS HAPPENED IN JUST 150 days.

Will it happen this time - I do not know, time will tell, but you always need to view some historical data as a precaution. How often in the past has BTC experienced such an adjustment as it is now in May? And what has it been about?

Every time such large adjustments occur, the BTC has fallen in the long run. And if we look at it graphically, it looks like a lot of BTC’s lifetime it is about corrections and falls.

Looking at the schedule this way - you want to be cautious. And as usual, it is clear that "timing" plays crucial part in all this. Of course, in the long run, the price is growing, but the adjustments are also long-lasting and rather painful. Another thing should be taken under consideration is that it would not be advisable to play with your leverage here. Because with such adjustments, your positions will automatically close with a loss. Because even when working with the shoulder 1:2 your account most likely won’t withstand such fluctuations. So, consider this as a friendly warning to those who wants to explore "get rich quick" schemes: you have been warned.

As we continue to look at BTC statistics, we also need to look at movements by “large BTC wallet holders”. Simply put – what happens to wallets that have 1000 and more BTCs. Do they continue to accumulate their BTC numbers, or have they started cashing in their profits? Previously this indicator has worked really well: when big wallets started to slowly sell their BTC then the market has experienced a correction.

And as we can see, when the price peaked, some of the big players sold their BTCs. If this trend continues, then the fall in prices will continue as well. Although Glassnode reports that this decline has now stopped and the accumulation period has begun.

My view is very simple. So far, I have kept the crypto in my portfolio until details of a possible adjustment appeared. So, I didn't want to experience another "crypto winter" and made a fixation. I did it purely technically – at a price of $ 47k when the graph drew a turning figure. Now BTC draws the figure again, only in the BUY direction. The data looks rather mixed, but with the potential to grow, So, am looking at buying options now.

And the Ethereum graph looks very similar. However, you have to keep in mind – even the potential is huge, the chances of falling are great as well. You must take this into account before making any moves. As I mentioned previously, if the price has adjusted by 50%, it has usually indicated the beginning of the adjustment period. Will it be this time as well? Time will tell. Will I look for some attractive "altcoins" to invest in? Not yet. I absolutely content with having only BTC and ETH.

And some fun fact in conclusion. The Crypto market fell by 50%, and the total market cap decreased by 50% or $ 1.3 trillion. The industry is not regulated, nobody declared bankruptcy, and no one had to be rescued. The system works and it has been that way from the very beginning. That’s what is truly impressive!

Stay tuned!

Agris

Comments